Why Choose Refrens as Your GST Billing Software?

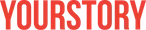

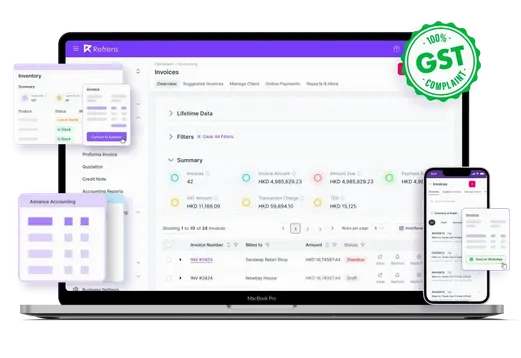

✅ Auto-create GST invoices, e-invoices, and e-way bills.

✅ Detect IGST, CGST, SGST by place of supply.

✅ File-ready GSTR-1, 3B & HSN/SAC summaries.

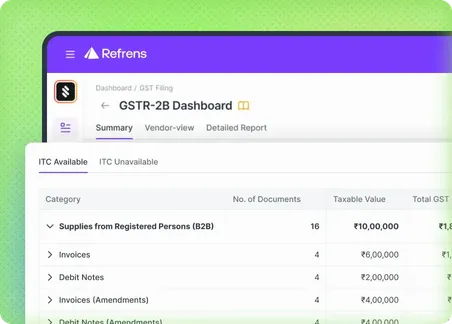

✅ Reconcile 2B data to claim accurate ITC.

✅ Track ITC, TDS, TCS & return deadlines.

✅ Auto-record journal entries, ledgers & vouchers.

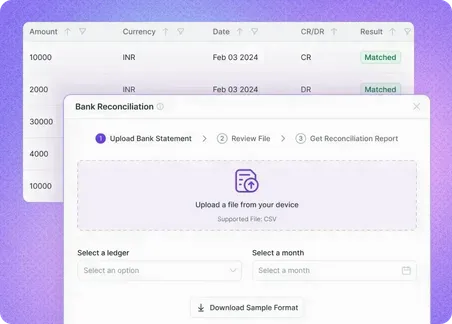

✅ Reconcile bank transactions in minutes.

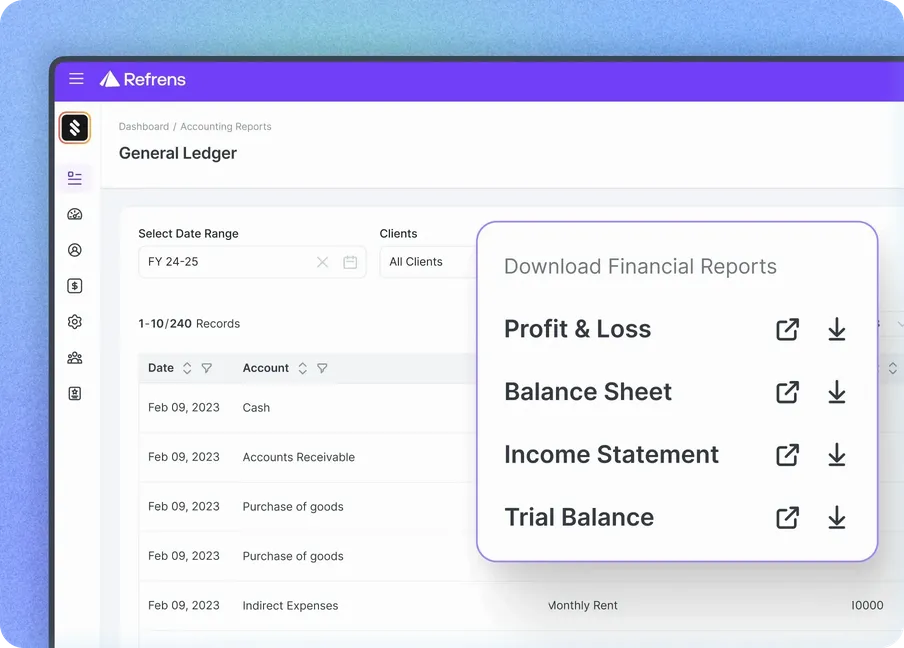

✅ Generate P&L, Balance Sheet & Cash Flow instantly.

✅ Get AI insights on profit, tax & spending with Freya.

✅ Maintain audit-ready, versioned books seamlessly.

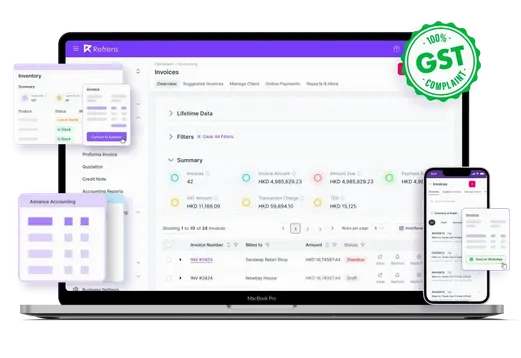

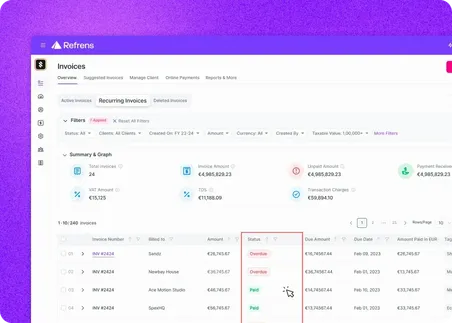

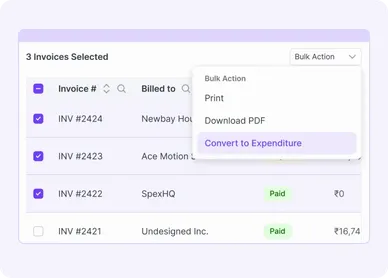

✅ Create GST invoices, quotations, and proforma invoices easily.

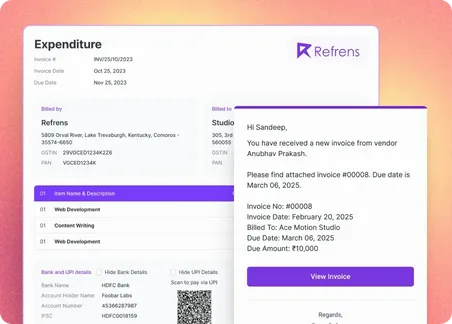

✅ Automate payment reminders through WhatsApp and email.

✅ Record partial payments, credit notes, and advance receipts.

✅ View client statements, ageing reports, and payment summaries.

✅ Match payments with invoices automatically for quick reconciliation.

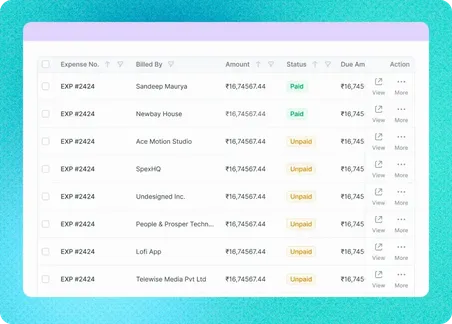

✅ Record vendor bills, purchase orders and expenses in one place

✅ Attach supplier invoices; scan bills with auto data capture

✅ Reconcile GST Form 2B with purchases to ensure input credit

✅ Track due dates and send alerts for pending vendor payments

✅ Approve expenses and verify tax numbers and bank details

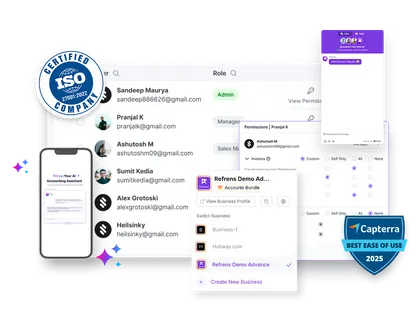

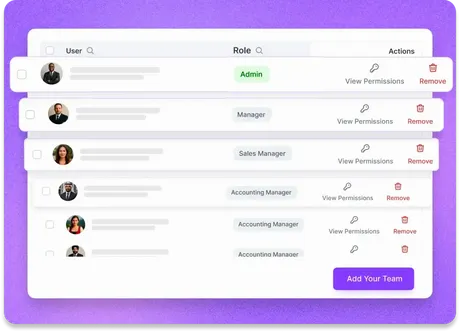

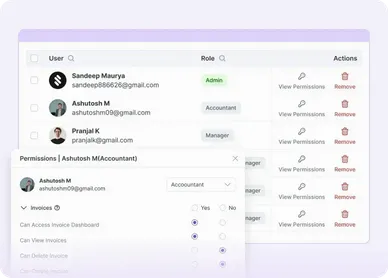

✅ Collaborate with multiple users and CAs using role access.

✅ Cloud-based with auto backups and top-grade data security.

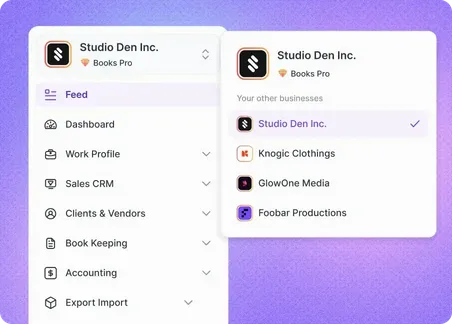

✅ Manage multiple companies and branches under one login.

✅ Get 24×7 support via chat, WhatsApp, and email anytime.

✅ Access your account securely from any device, anywhere.

Advance Features of Refrens GST Accounting Software

Generate GSTR-1 in JSON/Excel, reconcile GSTR-2B with purchase data, auto detect GST type, and track Input Tax Credit in real time. Generate e-Invoices and e-Way Bills in one click and stay 100% compliant with government systems.

Every transaction - whether a sale, purchase, or payment - automatically updates the right ledgers. No manual journal entries, no missed data. Refrens follow a complete double-entry accounting system for error-free books.

Sync your bank accounts and reconcile every transaction automatically. Identify mismatched entries, verify payouts and receipts, and approve corrections with one click. Keep your books accurate and audit-ready at all times.

Generate P&L, Balance Sheet, Trial Balance, Cash Flow, and Daybook instantly. Customize your chart of accounts, view project-wise profitability, and track tax liabilities, all in real time. Export reports in PDF & Excel format for easy sharing.

Create professional GST invoices, quotations, and proformas in seconds. Accept domestic or international payments, automate WhatsApp/email reminders, track ageing reports, and auto-generate payment receipts. Offer early-payment discounts to improve cash flow.

Record all purchases, expenses, and reimbursements in one place. Use OCR scanning to capture data directly from vendor bills. Automate recurring expenses, verify GST details, and reconcile GSTR-2B for accurate Input Tax Credit. Generate detailed vendor and ageing reports.

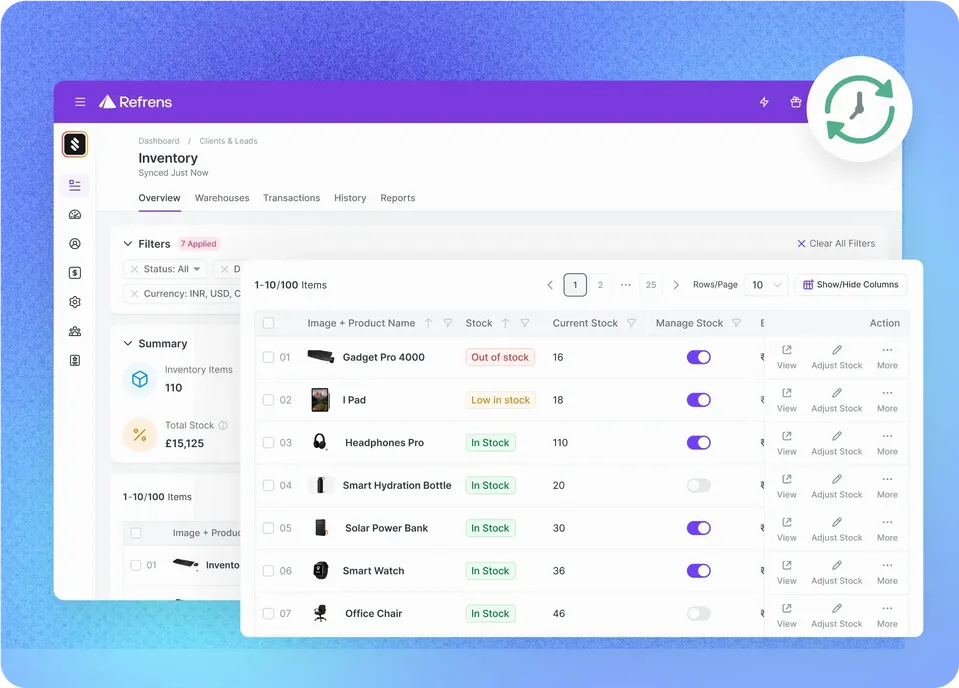

Keep your stock accurate across every sale and purchase. Auto-update inventory levels, manage warehouses and transfers, track batches and expiry dates, and generate delivery challans automatically. Monitor item-wise profitability and dead stock in real time.

Manage vendor onboarding, approvals, and payments with workflows. Verify vendor PAN, bank, and GST details instantly for safe businesses.

Invite your CA or team with role-based access. Customise role permissions to ensure your team has access to only what you have approved of.

Manage multiple businesses, branches, and currencies under one account. Customize invoice templates, taxes, and fields for each entity.

Access your accounting data anywhere - desktop, tablet, or mobile. Enterprise-grade encryption, daily backups, and audit trails ensure your data stays safe and compliant.

Accounting & Automation Features in Refrens GST Accounting Software

What customers say about Refrens GST accounting software

Frequently Asked Questions (FAQ)

Refrens GST Accounting Software is a comprehensive accounting tool designed to simplify GST compliance, streamline financial reporting, and automate essential accounting tasks for businesses. It offers multi-currency billing, real-time data analysis, and customizable invoicing, quotation and reporting features.

No, you don't necessarily need a Chartered Accountant (CA) to file your GST returns. Many businesses, especially small to medium-sized ones, can handle GST filing themselves with the help of GST-compliant accounting software like Refrens which guides users through the process and helps automate business.

Yes, Refrens is GST-compliant software that simplifies GST invoicing, filing, and reporting, making it ideal for businesses to manage their GST and accounting tasks efficiently.

FREE! Refrens invoice generator is free for every small business, agency, startup, and entrepreneur. You can generate 15 documents every year. Also, manage invoices and access free templates.

Refrens GST Software is an accounting tool designed to help businesses manage GST compliance easily. It offers features like GST-compliant invoicing, automated filing, multi-currency billing, and customizable financial reports. This software simplifies GST tasks, making it suitable for small and medium-sized businesses looking to streamline their accounting processes and ensure tax compliance.

- Easy billing with GST-compliant invoicing

- Accurate GST return filing, including forms like GSTR-1, GSTR-3B, and GST CMP-08

- Integrated solution for hassle-free e-invoicing and e-way bill generation

- Error prevention, detection, and correction features for smooth billing and return filing

- Regular updates to ensure compliance with the latest GST regulations

- Cloud Accounting Software

- |

- AI Accounting Agent

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software